The Business Credit Accelerator Program

Achieving business credit and financing has never been easier!

With the right system, you can establish business credit quickly, without the need for a personal credit check or a perfect credit score.

We believe that anyone can get the funding they need to run and grow their business.

Our proven system has helped countless entrepreneurs and business owners secure business credit and financing in record time.

Don't let a less-than-perfect personal credit score hold you back from achieving your business goals.

With our system, you can take control of your financial future and secure the funding you need to succeed. Join us today and see how easy it can be to get the business credit and financing you deserve!

Unlock the True Power of Business Coaching For Entrepreneurs With The Business Credit Accelerator Program: It's More Than Just Money—It's About Realizing Your Potential as a Business Owner

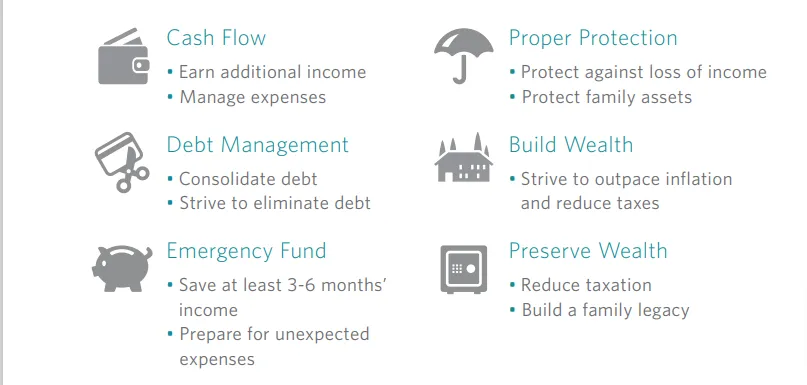

Business credit and funding coaching provide you with more options to:

Start a business

Acquire new equipment

Get Vehicles and Fuel

Grow an existing business

Hire employees

Advertise

Discover Why Smart Entrepreneurs Trust Our Proven Coaching System

Are you a savvy business owner with dreams of taking your company to new heights, but find yourself held back by a lack of funding? You’re not alone.

Countless brilliant entrepreneurs and thriving businesses struggle to secure the credit and financing they need to achieve their goals and support those they care about most.

But what if we told you that the key to unlocking business success is within your reach? Our CORE program has already helped over 40,000 businesses like yours navigate the complex and ever-changing landscape of business credit and financing.

So, why do so many smart people and great businesses fail to get the funding they deserve? The answer may surprise you. In today’s fast-paced and intricate business world, attempting to go it alone is a recipe for frustration and disappointment.

With the right procedures, protocols, and personalized guidance from our team of experts, your chances of success skyrocket.

We understand that building rock-solid business credit is a process, but with our proven system and the support of a dedicated advisor, you’ll have the confidence and knowledge to secure the funding you need to thrive.

Our experience and expertise have already helped over 40,000 business owners turn their dreams into reality, and we’re here to do the same for you.

Imagine the possibilities that open up when you have the financial resources to grow your business, hire top talent, and take on exciting new projects. With our CORE program, you’ll have the tools and support you need to make that vision a reality.

Don’t let a lack of funding hold you back any longer.

Take the first step towards a brighter future for your business by enrolling in our CORE program today.

Our team is ready to guide you every step of the way, providing the personalized advice and expertise you need to succeed.

Your journey to securing the business credit and financing you deserve starts now.

Our Mission - Financial Management, Streamlined Business Financing, and Credit Education For Entrepreneurs

We help entrepreneurs, business owners and investors learn how money works, secure business credit, credit lines, and funding without the hassle of navigating complex financial processes, in less time than it would take on their own.

Created to Help You Secure the Business Credit and Funding You Need to Succeed

You get instant access to a series of powerful and exclusive resources to help you obtain the business credit and funding you need. Additional resources are available to help you grow and run your business more effectively.

The Business Coaching & Credit Accelerator System For Entrepreneurs provides you with:

A 7-step, easy-to-follow online business coaching system and video educational platform that provides you with the knowledge and a clear plan for establishing and building a rock-solid business credit profile that lenders will be eager to support and fund.

STEP 1: Business Foundation

Discover how to set up your business with the right structures and practices to gain approval from major lenders. This boosts your business's credibility and increases your chances of securing the funding you need.

STEP 2: Establish Business Reports

Learn how business credit reporting works and get your company registered with major credit bureaus like Dun & Bradstreet, Experian, and Equifax. This enhances your business's credibility and increases your chances of securing funding and favorable credit terms.

STEP 3: Tier 1 Applications

Apply for your first business credit accounts to begin establishing your business credit.

STEP 4: Monitor Your Business Reports

Understand how your business is perceived by major credit bureaus like Dun & Bradstreet, Experian, and Equifax, and learn how to fix any errors. This insight helps enhance your business's credibility and improves your chances of securing favorable credit terms and funding.

STEP 5: Tier 2 Building Credit

Continue building your business credit by adding 3 more trade accounts, enhancing your creditworthiness and unlocking greater funding opportunities for your business growth.

STEP 6: Tier 3 Building Credit

Add 3 more trade accounts to further solidify your business credit profile, opening doors to even more substantial funding opportunities and demonstrating your business’s growing financial strength and reliability.

STEP 7. TIER 4 BUILDING CREDIT.

Add 3 additional trade accounts, bringing your total to 12 accounts. This helps you establish strong business credit built solely under your business EIN number, enabling you to qualify for lines of credit without relying on your personal credit. This not only protects your personal finances but also enhances your business's credibility and funding opportunities.

Personal Credit Enhancement & Monitoring Coaching

You gain access to a platform that monitors your business credit. This is extremely important as it allows you to track your progress from having no business credit to building rock-solid business credit.

Business Enhancement Coaching

Workforce Retirement & Insurance Benefits

Retirement Employer Sponsored Plans

Plan Services + Investments

401K & IRA Rollover Solutions

Financial Professional Resources

Annuities

Employee Benefits

Employee Benefits Solutions

Employer Paid Insurance

Supplemental Health + Disability Group

Term & Permanent Life Insurance Options

Estate Planning - Will & Trust Advisory

Access to Your Very Own Personal Business Advisor (Priceless)

You will have access to a business credit and funding advisor who will guide you through the process, ensuring you take the right steps to build business credit and secure funding for your business.

Client Testimonials

Chermaine Parks

Entrepreneur in Financial Services

"As a Entrepreneur there's nothing better than having access to the Business Credit Builder System. I have everything my business needs to build credit and secure direct financing. I was able to get $70K in funding for my business in just 7 days. If you want to build business credit the right way, enroll in the Business Credit Builder Program."

Haydee Dinero

Author, Speaker, & Financial Coach

" I have a Degree in Finance I learned things never taught in school. . I learned so much about business credit and funding working with the business advisors. The Business Credit Builder Coaching Program for Entrepreneurs is unlike anything I've ever experienced. I refer all my clients to the program and use it as a vital tool for my financial coaching business."

Jason Yorker

Sports & Entertainment Business

"As an entrepreneur and actor, I don't have time to figure it all out on my own. Business Credit Nation and the advisory team take all the hard work and guessing out of the equation. The Business Credit Builder Program is a great investment, providing access to business credit and funding all in one place with a world class financial management education."

The Business Coaching & Credit Accelerator Program For Entrepreneurs

YOU GET ALL ACCESS IN ONE ORGANIZED PLACE

Credibility Foundation

411 Credibility Listing

EIN and Entity Setup Assistance

Business Name Credibility Check

Bank & Merchant Account Setup Assistance

Business Address Credibility Check

Website & Email Credibility Check

Business Phone Credibility Check

Business Audit

Bonuses:

Personal Credit Audit

Marketing Audit

FB Group Coaching

Business Tradeline

Funding Education

Business Credit & Score Training

Get Setup with D&B, Experian & Equifax

Access High-Limit Store Credit Cards

Access Auto Vehicle Financing

Access High-Limit Fleet Credit Cards

Access High-Limit Cash Credit Cards

Exclusive Access to Starter Vendors

Exclusive Access to Advanced Vendors

Credit Card Stacking Training

Financing Access

World Class Financing Support Team

Unsecured, No-Doc, 0% Financing

Save 90% on Full Credit Monitoring

12 Months of Business Advisor Support

Auto Financing with No Personal Guarantee

Secure Business Loans within 72 Hours

Get Loans with Rates of 5% and Less

3 Rounds of Funding

EASY PAYMENT OPTIONS FOR YOUR BUDGET

Small Call to Action Headline

9 MONTHLY PAYMENTS

Easy Monthly payments

$497 month

SINGLE PAYMENT

SAVE MORE THAN $900

$3,497

25 Powerful Reasons to Invest in the Business Coaching & Credit Accelerator Program for Entrepreneurs

1. Expert Guidance: Get business credit and funding with help from industry experts.

2. Business Growth: Use your business credit and funding to grow and increase the value of your business.

3. Increased Success: Dramatically improve your chances of success with the Business Credit Accelerator Program on your side.

4. Expert Advice: Access to an expert who will provide advice and answer all your questions.

5. User-Friendly Platform: Easy to use through an intuitive online platform.

6. Simplified Process: It’s an extremely complex process, but we make it simple.

7. Accelerated Timeline: This process can take years if you go it alone, but with our program, it usually takes just 6 months.

8. Tailored Matching: We’ll set you up with the right lender or funding entity for your business.

9. Long-Term Access: Gain access to The Business Credit Accelerator Program for 5 years.

10. Clear Strategy: Gain a clear picture of how you’re going to get the business credit and funding you need.

11. Extensive Network: Get access to hundreds of lenders with billions of dollars to lend to small businesses. We know how to find and contact these lenders.

12. Versatile Funding: Find credit and funding to grow an existing business, start a new one, hire employees, acquire new equipment, open new locations, or advertise for new clients.

13. Attractive to Lenders: Discover how to make yourself highly attractive to lenders through knowledge, training, and education.

14. Proven Success: A strong track record of helping businesses succeed through the intelligent use of business credit and funding.

15. Positive Reviews: Thousands of positive reviews and media attention from national business publications.

16. Recognized Excellence: We’re a member of the prestigious Inc. 5000 list of fastest-growing businesses in America.

17. Valuable Investment: One of the best investments you can make in your business and your life.

18. Solid Credit Building: Build rock-solid business credit the right way.

19. Credit Reporting: Understand how business credit reporting works and how to build strong business credit.

20. Separate Credit: Get business credit that’s not linked to your social security number and personal credit.

21. Additional Resources: Access additional resources to help your business grow with help from carefully-chosen partners.

22. Exclusive Access: Access recordings from our special event, The Funding 30 Challenge, and “meet” lenders who want to help your business grow.

23. Proper Setup: Discover the right way to set up your business and the wrong way, from choosing the right entity to listing your business address.

24. Credit Repair: Fix damaged business credit if that’s an issue.

25. Affordable Investment: Very affordable and a great investment.

One of The Best Investments You’ll Ever Make In Your Business

The Business Credit Accelerator Program is a financial investment in your business. We understand this, which is why we offer a convenient payment option. Plus, we instantly build your business credit and report it to the business credit exchange, giving you an immediate business credit trade line from us.

But let’s consider the powerful investment you’re making and how it will benefit your business:

1. Increased Success: Your chances of getting the business funding and credit you need will skyrocket.

2. Simplified Process: We show you how to make an extremely complex process super easy, saving you hours of time.

3. Accelerated Timeline: A process that can take several years will be completed in approximately 6 months.

4. Essential Funding: You will get the funding you need to invest in your business.

5. Financial Growth: This can increase revenue, improve cash flow, and enhance both the short-term and long-term value of your business.

6. Lender Connections: We’ll connect you with excellent lenders through our extensive network.

If you decide to go it alone, two things are likely to happen:

1. Limited Success: You probably won’t get the money you need.

2. Wasted Time: You’ll spend countless hours spinning your wheels.

Invest in the Business Credit Accelerator Program today and set your business on the path to success.

Who Should Invest in Business Credit Accelerator Program…

And Who Should NOT.

Acclerator Program is for:

Ambitious business owners.

Start-ups

Established businesses.

Businesses from every category.

People who have struggled in the past

finding business credit.

Business owners who are new to the process.

People who want access to this expertise and understand the powerful value.

Acclerator Program is NOT for:

People who are unwilling to invest in their business.

People who think they can go it alone and simply find the information elsewhere.

People who aren't willing to work with us to build real value in the business.

Can't I just go to my bank?

Yes … your bank might lend you money. But, in most cases, other lenders in our exclusive network will provide better terms and easier access to funds. Plus … even if you decide to go to a bank for money, you must have everything correctly organized in your business. Your FUNDABILITY should be really high.

Can't I just find the information myself?

And yes … there's plenty of information available … for free … elsewhere.

But there's a problem. Things change rapidly in business credit.

So the information you get might be outdated or just plain wrong. Plus just finding the correct information can take huge amounts of time.

You can go it alone here and not invest in the ACCELERATOR Program but you'll likely get lost in that maze. We will always provide you with the correct information. And the ACCELERATOR Program will save you vast amounts of time.

Apply For The Business Accelerator Program

Yes … You Will Have a REAL HUMAN BEING On Your Side

The Business Credit Accelerator program provides you with a deep well of powerful online resources. But even better, when you join this program, you get a personal consultant who will provide guidance plus be available to answer your questions.

You will have access to a Business Advisor for 5 years.

This means we want you to have the resources and information you need to be successful … through the intelligent use of business credit and business funding.

Frequently Asked Questions

What is a Business Credit Bureau?

A business credit bureau is an agency that collects and researches data on businesses and sells it for a fee to lenders and credit issuers to make lending decisions. It may also be called a commercial business credit reporting agency, or a corporate credit bureau.

What is a Business Credit History?

A business credit history is the number of trade payment experiences which are reported on business credit reports. This includes payment terms.

What Does it Mean to Establish Business Tradelines?

Establishing business tradelines is the act of applying to and using accounts that report to the business credit bureaus.

What are Business Credit Reports?

These are reports produced by business credit bureaus highlighting a business foundation, and reporting business credit history, scores and ratings. These reports are compiled to help lenders and business owners access risk

What Does it Mean to Build a Business Credit Profile?

A business credit profile is all the information included on all your business credit reports including all your business tradelines, business information, and business credit scores. Building your business credit profile means to improve accuracy and accumulate positive experiences and information which present your business in a favorable light.

What is a Personal Guarantee?

A personal guarantee is an individual’s legal promise to repay credit issued to a business where they are an owner, executive, or a partner.With business credit agreements, giving a personal guarantee essentially makes you a co-signer on the business credit account. You will remain liable for any debts the business incurs. You have given a “personal guarantee” that you will be responsible for the debt.In practice, this means that your personal credit will undergo a hard inquiry, since you are putting your Social Security number on the credit application. With enough hard inquiries, your personal credit score will be adversely affected.

What is a Trade Vendor?

A trade vendor is a vendor that issues trade credit, and trades product or services.

What is Trade Credit?

Trade credit is issued by vendors to businesses for the purchase of goods or services.

What is a Vendor Account?

A vendor account is an account issued to a business with a vendor. It is sometimes reported to the business credit bureaus. The term trade account is common, but it is more accurate to call this account a vendor account.

What are Business Tradelines?

Business tradelines are vendor accounts reported by the vendor to a business credit bureau. This information is included in a specific location in a business credit report.

What is a Trade Payment Experience?

When a businesses’ payment activity in relation to a new or continuously reported tradeline is recorded by a business credit bureau.

What are NAICS Codes and SIC Codes?

NAICS (North American Industry Classification System) codes classify businesses by industry. As an example, a dry cleaning business would come under812320Drycleaning and Laundry Services (except Coin-Operated).The NAICS codes are the standard used by Federal statistical agenciesin classifying business establishments for the purpose of collecting, analyzing, and publishing statistical data related to the U.S. business economy.The IRS also uses NAICS codes.

While reviewing your business tax returns, the IRS will compare yours with other businesses in your industry, to make sure that your claimed deductions are sufficiently similar to those of your industrial peers.Standard Industrial Classification (SIC) codes are four-digit numerical codes assigned by the U.S. government to business establishments to identify the primary business of the establishment.

SIC codes are being replaced by NAICS codes, but organizations such as Dun and Bradstreet still use SIC codes or even both.

Two of the bigger differences between SIC and NAICS codes are that the NAICS codes list is more detailed, and it does not differentiate between online and offline businesses.

Is There Such a Thing as a Business Credit Inquiry?

You may be wondering: do business credit inquiries hurt my credit?Unlike with personal credit, anyone can pull your business credit reports. This does result in inquiries.However, unlike with personal credit, business credit inquiries don't negatively affect your Fundability or business credit scores with each business credit bureau.

What are Hard Inquiries and Soft Personal Credit Inquiries?

Credit inquiry is when a lender pulls someone’s personal credit record. It creates a record in a credit report of each time the borrower, a lender or a potential lender gets a copy of a person’s credit report.

Credit inquiries, especially multiple inquiries, may negatively impact credit scores.Hard InquiriesIn a hard inquiry (also called a hard pull), a potential lender checks a person’s credit report. An occasional hard inquiry will only have a small negative impact on a credit score. But hard inquiries stay on a credit report for two years.

Several hard inquiries over a long period will hurt a personal credit score the most. This is because they are viewed with suspicion, as they could signal the borrower has fallen on hard times.Soft InquiriesA soft inquiry (or soft pull) is a credit report check that does not affect a borrower’s credit score. Soft inquiries come from eval uations not resulting in the granting of credit. For example, you can check your own credit as much as you like without it affecting your score. Another type of soft pull is periodic checks by existing creditors. It’s also a soft inquiry when credit information is pulled by insurance companies while deciding whether to offer insurance. That’s right: business credit and underwriting go together.

What is an EIN?

EIN stands for Employer Identification Number. It is a nine-digit number assigned by the IRS, used to identify the tax accounts of employers and certain others with no employees. The IRS uses the number to identify taxpayers who are required to file various business tax returns. EINs are used by employers, sole proprietors, corporations, partnerships, nonprofit associations, trusts, estates of decedents, government agencies, certain individuals, and other business entities. Get your EIN for free directly from the IRS.

What Does the Term ‘Newly Reported Tradelines’ Mean

A business tradeline is referred to as newly reported if it is up to 6 months old and has reported payment experiences.

What Does Continuously Reported Mean?

A continuously reported business tradeline is one that is over 6 months old that has reported multiple payment experiences.

What Are Business Credit Tiers?

Business credit tiers are actually our coaching terminology. Our business credit advisors continually check and recheck vendors and other credit and business financing issuers. There are differences in terms of how easy or difficult it is to be accepted for credit, and what you may need to provide to qualify.

For example,business credit tier 1 is vendor credit, where you need very little to get started. You can qualify with few payment experiences on your business credit reports.

You may be able to qualify with a short time in business, such as six months.

Or you may be able to get around certain more stringent requirements by offering a personal guarantee or making a deposit to secure the credit.

And to get to business credit tier 2, you will need to have at least three trade accounts reporting to the business credit bureaus.

What is The Business Credit Accelerator Builder Program?

The credit builder and finance program can help you build business credit by doing the heavy lifting for you.

We have a team dedicated to finding and maintaining hundreds of business credit accounts.

The Business Credit Accelerator Builder Program will help you understand and improve your business credit and funding profile, establish your business credit profile, get business credit accounts, and even give you access directly to lending opportunities.

We help you get set up with business credit reporting agencies, and research business credit accounts which report to the business CRAs. This is high level stuff. If it is not done correctly it may cause you costly errors and downtime

The System know's when to apply for credit accounts, and which loans and cards to apply for, and in which order.

This is to maximize approvals and minimize the time it takes to get and build business credit.

Business Credit vs Business Loan: Which is Better?

When it comes to financing your business, you may think that business credit and loans are 100% separate. But the truth is, they aren’t.In particular, business owners with bad credit can have their good business credit help them get loans. After all, business credit is one of the 5 main Fundability principles. When a lending institution has more than just your personal credit scores to look at, they will review any other information which they believe will better answer their one big question: will you pay them back?

Because it’s possible to have good business credit with bad credit on the personal side. But if your business credit is good enough for a lender, they will weigh it more heavily in their decision

.Business Credit: How it Works When Seeking Loans Lending institutions will let your business credit guide them as they pull your business credit reports and look for a few things.

Do you pay your bills on time?

Are there a lot of negative/derogatory items on your credit reports, such as lawsuits or liens?

How long have you been in business?

Is the business credible?

Does the information on the business credit report match the information received on the application?

If the answers to these questions satisfy the lending institution, then you’re more likely to get a loan, although it will not necessarily be for exactly the amount you were originally seeking.